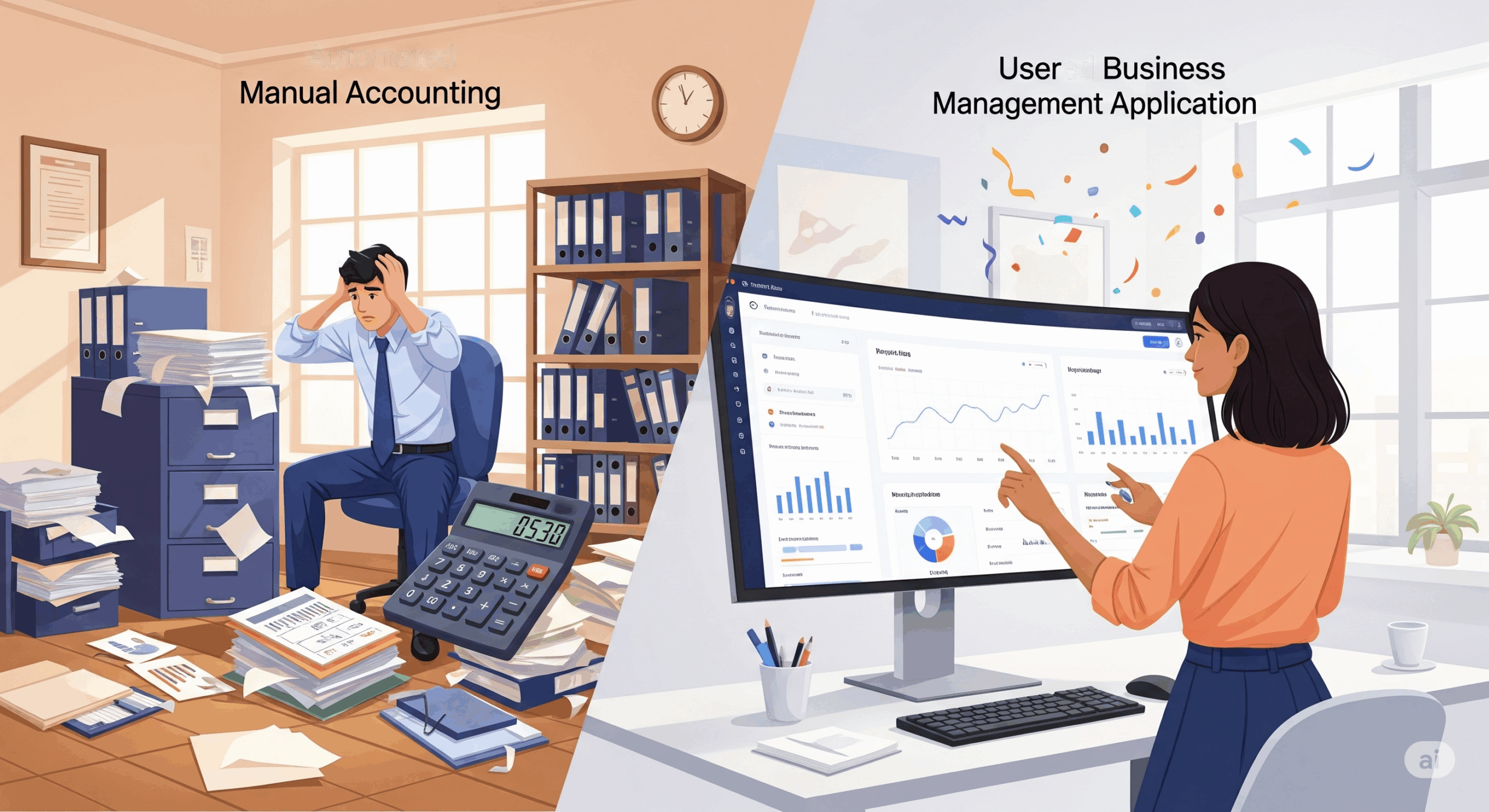

For many budding entrepreneurs and even established businesses in Pakistan, the journey often starts with manual accounting methods. While seemingly cost-effective initially, relying on pen, paper, and basic spreadsheets can quickly become a bottleneck as your business grows. If you’re weighing the pros and cons of sticking with manual accounting versus adopting modern accounting software in Pakistan, this blog post highlights why businesses of all sizes are making the switch to ERPOS.

Manual accounting is time-consuming, prone to errors, and offers limited visibility into your overall financial health. Imagine spending hours manually entering invoices, reconciling bank statements, and trying to generate even basic reports. This not only takes away from focusing on core business activities but also increases the likelihood of mistakes that can have serious financial consequences. ERPOS, a user-friendly accounting software for small business and large enterprises, offers a compelling alternative. It automates data entry, streamlines workflows for sales and purchases, and generates accurate financial reports in seconds. Features like integrated banking management eliminate the hassle of manual reconciliation, while comprehensive expense tracking ensures you have a clear picture of where your money is going.

Furthermore, ERPOS offers scalability. What might work for a very small operation will quickly become inadequate as you grow. ERPOS can adapt to your business needs, whether you’re a small shop with a few customers and vendors or a larger enterprise managing complex transactions and inventory. The ability to manage everything from a centralized platform, access data anytime, and potentially from any device (depending on the specific ERPOS features) provides a significant advantage over the limitations of manual systems. Make the smart switch to ERPOS and empower your business with efficiency, accuracy, and the insights needed to thrive in today’s dynamic market.